Investor Relations Insights: Investor Day Recap and Frequently Asked Investor Questions

Hello,

I hope you are well. Honeywell hosted its 2023 Investor Day at the Nasdaq MarketSite in New York City earlier this month (click here for the presentation materials and webcast replay). We also had the opportunity to ring the opening bell for Nasdaq on the two-year anniversary of our listing with the exchange. Since the event, we’ve been on the road meeting with more investors, fielding questions, and collecting feedback on our updated strategy and outlook.

In this note we’ve compiled the most Frequently Asked Investor Questions (FAIQ) in our discussions post-Investor Day, including some topics related to other current events. We welcome your feedback and questions as well!

Sean

Sean C. Meakim, CFA

Vice President, Investor Relations

Honeywell International

What were the key messages coming out of Honeywell’s 2023 Investor Day?

Honeywell’s 2023 Investor Day provided an update to Honeywell’s financial commitments and served as an unofficial transition from Darius’s leadership to Vimal’s. The key messages were:

- Under CEO Darius Adamczyk’s tenure, we have transformed Honeywell through our key ISC transformation, Honeywell Digital initiative, and Honeywell Connected Enterprise software capabilities, which will enable us to enter a new phase of growth under CEO-elect Vimal Kapur’s leadership. Honeywell outperformed the XLI in five out of six years in Darius’s time as CEO.

- We upgraded our financial commitments in three of our four segments, raised the upper-bound of our segment margin and free cash flow margin targets, and recommitted to at least $25 billion of capital deployment over the next three years

- We detailed our robust, disciplined M&A process and highlighted that the market for M&A right now is as favorable as we have ever seen it in recent years

- We highlighted our continued alignment to key environmental, social, and governance principles, including an upgraded sales commitment in our Sustainable Technology Solutions business

- We feel good about the alignment of our portfolio to key megatrends and our growth potential

What updates did Honeywell make to its long-term financial commitments? What are the drivers of the increased growth and margin expectations in some of the segment-level targets?

Vimal reaffirmed Honeywell’s commitment to the upgraded financial algorithm we introduced last year at our 2022 Investor Day. Given what we’ve learned about our businesses and the markets they serve over the past ~14 months, we enhanced several parts of the algorithm, further strengthening the case for growth acceleration in the coming years.

First, we upgraded several of our segment-level organic sales growth and segment margin targets. In Aerospace, the demand environment continues to be strong and stronger demand signals in our defense and space business have given us the confidence to upgrade our view on organic sales growth from MSD to now MSD – HSD over the long term.

In HBT, an exceptional commercial performance in 2022 led to faster segment margin expansion than we anticipated at our 2022 investor day. That business is now already operating near our previous long-term segment margin target, leaving us in a position to further upgrade our target from ~25% to now ~27%.

Similar to HBT, SPS is also already operating near the long-term segment margin target laid out last year. The current digestion period in new warehouse capacity investments and automation projects has resulted in a sales mix benefit to margins, as has the continued strong growth in the aftermarket services portion of the business. This, combined with the cost actions we have taken to right size the business, has created a pathway to upgrade our long-term target to the high end of the previous range at ~20%.

These enhancements to our segment-level targets give us confidence to upgrade the upper bound of our overall Honeywell segment margin target to 25%+ (see table below for a summary of the sales and segment margin target changes). In lockstep with the segment margin upgrade, we also raised our long-term free cash flow margin target from mid-teens to mid-teens-plus.

In addition to updating the framework we laid out last year, we also introduced a few more long-term aspirations to provide more color on how we will achieve our financial framework. In the long term we plan to:

- Increase recurring revenue to 35%+ of total Honeywell sales (v. 32% in 2022)

- Increase total Honeywell gross margin to 40%+ (v. 37%1 in 2022)

- Grow sales in our high growth regions +DD% organically

This event was the ceremonial passing of the torch from Darius to Vimal. What were the key takeaways from Darius’s presentation?

One of Darius’s key focus points throughout his time as CEO has been to simplify and digitize the business through our ISC transformation, Honeywell Digital initiative, and Honeywell Connected Enterprise software capabilities. With Honeywell Digital, since 2018, we have reduced our ERP systems from 148 to 14 and driven $2 billion in cumulative gross margin, productivity, and working capital benefits. Through our ISC efforts, we have reduced our site count by 38% since 2017 while increasing gross profit per square foot by over 20%.

During this time, we have also transformed our portfolio through 16 acquisitions (such as Sparta and Intelligrated) and 5 spin-offs and divestitures (such as Garrett and Resideo). These portfolio moves have enabled us to accelerate from 1% average yearly organic growth in 2014 - 2016 to 5% average yearly organic growth from 2017 - 2022 (excluding COVID-impacted 2020), while expanding segment margin by 340 basis points since 20162.

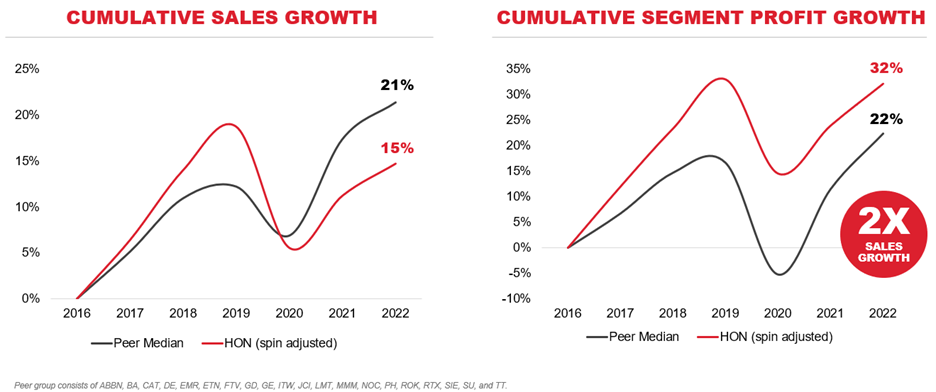

These transformation efforts have had a dramatic effect on our segment profit, which has grown twice as fast as our sales since 2016. Over the same time period, our share price approximately doubled, and we beat the XLI in five of the six years.

While we are entering a new phase of growth under Vimal’s leadership, Darius will continue to serve as Honeywell’s Executive Chairman at least through April 2024, supporting Vimal through his focus on portfolio shaping, customer relationships, and strategy.

Exhibit 1 – Cumulative Growth Since 2016

Source: Honeywell 2023 Investor Day Presentation

What are Vimal’s top priorities as he takes over as CEO?

As a 34-year veteran of Honeywell with deep expertise in our businesses, end markets, and customers, Vimal will ensure that the CEO transition is seamless. He is focused on ensuring that Honeywell continues to focus on its consistent, winning strategy while shifting our areas of focus to drive a new phase of growth.

Under Vimal’s leadership, we will continue to deliver on our upgraded financial framework, helping ensure that our say matches our do. We will remain resilient to help enable outperformance in all macroeconomic environments. Additionally, we will maintain and enhance our leadership position across ESG.

Organic growth acceleration will be driven by our enhanced innovation playbook, our leadership in software and sustainability, and our strong presence in high growth regions. Our new Global Design Model strategy through our Accelerator operating system enables our highest performing businesses to share best practices, improving performance across the company. Finally, we will continually review the portfolio and broader market to help drive gross margin improvement, higher software and recurring sales mix, and ESG-oriented revenue.3

How does Honeywell plan to accelerate its organic growth?

We will accelerate our organic sales growth by focusing on our innovation playbook, expanding our SAM by taking our existing offerings to new markets (through EV sensors, Solstice for heat pumps, and more) and delivering new offerings in our existing markets (via HCE, electrification in Aero, and more). In addition to SAM expansion, we will continue to fund and cultivate our Breakthrough Initiatives that are long-term technology bets (such as Quantinuum, Advanced Aerial Mobility, and more) that offer upside to our long-term financial targets. Our R&D spend will likely remain 4% - 5% of our annual sales, with an additional 3% - 4% through customer-funded R&D.

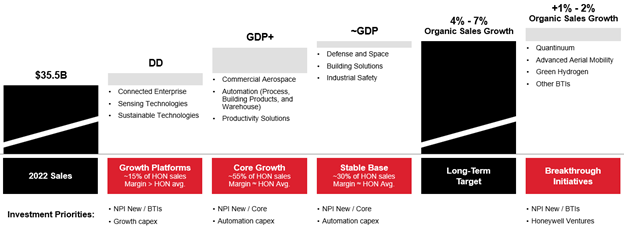

We unpacked our portfolio by growth profiles to demonstrate what’s required to reach the high end of our organic sales growth algorithm, pictured below:

Exhibit 2 – Portfolio Growth Composition

Source: Honeywell 2023 Investor Day Presentation

How does software fit into Honeywell’s growth plans, and what are the drivers of the $750M target in increased sales through 2025?

We are on the pathway to $2 billion+ in sales in Honeywell Connected Enterprise (v. ~$1.5 billion today), which will drive $750 million of Honeywell’s three-year incremental growth. HCE underpins our sales across all four segments, growing at approximately three times the total Honeywell rate at accretive margins. The growth we are seeing in this business, which will primarily be driven by new product introductions such as those seen at our Fall Launch event in 2022, is a key reason why we are confident in our long-term framework.

Our software-related offerings are not only limited to our HCE business. In total, around 25% of total Honeywell sales (or ~$9 billion) can be attributed to software and related offerings, and we will continue to innovate and accelerate growth in this margin-accretive portion of our portfolio.

What is Honeywell Accelerator and how can it enable the company to achieve its growth targets? What can the financial impact of Accelerator be for Honeywell over time?

Accelerator is Honeywell’s operating system, which contains all the best practices, tools, and digital platforms to enable us to deliver best-in-class performance. We have been iterating on Accelerator since 2005, when it was called HOS Gold and focused on improving productivity in our ISC operations. Under Darius’s leadership, we enhanced the scope to improve commercial processes, elevate our customer experience, and invest in digital. Now, rebranded Accelerator and under Vimal’s leadership, we are driving end-to-end standardization into our four predominant business models (projects, services, products, and software) and accelerating profitable growth through instrumenting Global Design Models. Through GDMs, we see a long runway ahead to provide additional value to Honeywell.

We see our Global Design Model as a new, third lever to margin expansion, beyond the traditional ones of productivity and price. The GDM approach creates best practices by business model, defines roles and responsibilities for each employee, institutes key KPIs to measure performance, and enhances digitalization across Honeywell. This allows us to lift our individual Gold Business Enterprises (GBEs) to best-in-portfolio benchmark performance levels, driving increased organic sales growth, gross margin, and cash generation. Overall, we see Accelerator resulting in 100 – 200 bps of incremental segment margin expansion potential over the long term. This process also allows us to rapidly integrate M&A and more quickly realize cost synergies.

What is Honeywell’s latest thinking about capital deployment? How will the company achieve its renewed commitments?

Capital deployment is an integral part of our Value Creation Framework. We are disciplined in balancing our capital deployment allocations to maximize shareowner value. Over the past several years, we have consistently deployed more than 100% of operating cash flow to fund share repurchases, dividends, M&A, and capital expenditures, all while maintaining an A-rated balance sheet and industry-leading return on invested capital.

When looking at the path to achieve our commitment to deploy at least $25 billion over the next three years, each of these capital uses will be part of the strategy. Specifically, we are committed to:

- Dividend growth: Growing our dividend roughly in line with our earnings growth (this will equate to ~$9 billion over the commitment horizon)

- Capex: Funding high-returning capex to accelerate organic sales growth and improve profitability (guiding ~$1 billion in 2023 and ~$3 billion over the next three years)

- Share Repurchases: Reducing our weighted average share count by at least 1% annually via share repurchases, while remaining opportunistic for further repurchases depending on valuation

- M&A: Prioritizing strategic, bolt-on acquisitions with an optimal deal size of $1 billion to $7 billion for the remaining gap to our $25+ billion commitment

Exhibit 3 – Capital Deployment Focus

Source: Honeywell 2023 Investor Day Presentation

What are Honeywell’s M&A priorities and how does the company prosecute its M&A pipeline? Are M&A priorities changing as Vimal takes over as CEO? Has the rising interest rate environment changed the competitive landscape for potential acquisitions?

We are focused on enhancing our existing portfolio with attractive bolt-on M&A in the $1 billion to $7 billion deal size range. When looking at potential acquisition targets, there are several characteristics that we prioritize, both for the industry and the specific company.

The industry characteristics that we prioritize include:

- Large total addressable market opportunity

- Above GDP industry growth rate

- Strong alignment to megatrends, such as the energy transition or digitalization

Then within the targeted industry, we prioritize businesses that have:

- Above industry growth rates

- High gross margins

- Less cyclical

- Technology differentiation

We take a proactive one-Honeywell approach to pipeline creation. Within the segments, we have dedicated strategy and business development resources that take a market-back approach to identifying the most attractive spaces to grow. Using that strategic plan, the business teams will review opportunities before bringing them to our corporate deal review board chaired by SVP and General Counsel Anne Madden and SVP and CFO Greg Lewis. From there, our most attractive potential targets are brought to a monthly pipeline review with the CEO.

These priorities are not new or changing under Vimal’s leadership, but we expect Honeywell will be more active in M&A markets in the next few years, largely due to 1) the transformational efforts completed during Darius’s time as CEO and 2) a more favorable competitive landscape for deals in a higher interest rate environment. The evolution of our Accelerator operating system and the investments in our Honeywell Digital infrastructure leave us much better equipped to execute and integrate strategic acquisitions, raising the probability of successful value creation. Meanwhile, our fortified balance sheet provides us with a relative advantage in what is increasingly a buyer’s market.

How is Quantinuum progressing, both technologically and commercially? Have your expectations for the sales growth trajectory changed at all since your last investor day? Do you still plan to monetize your position in Quantinuum over the medium term?

We continue to see great progress at Quantinuum. Since the combination with Cambridge Quantum Computing around a year and a half ago, they have made several technological strides, including setting records for highest ever quantum volume, launching a quantum-encrypted cybersecurity offering, and establishing a state-of-the-art quantum computational chemistry software platform. In May 2023, Quantinuum unveiled its next-generation H2 quantum computer, which will allow for even greater computational power and lead the world in advancement of quantum computing technology.

The current macro environment has led to customers delaying investments in this new technology as it is seen as more discretionary spend today, but our overall view of the growth trajectory is unchanged. While the exact timing of the commercial ramp can be difficult to forecast, we expect customer demand to be driven by quantum computing power exceeding that of classical computers, which we think could happen in the next few years. Quantum computing has the potential to unlock major advancements in natural language processing and artificial intelligence, and we are excited to see Quantinuum play a role in this rapidly maturing space.

We remain highly confident that Quantinuum has the potential to become a multi-billion-dollar business, and our plan is to monetize our position in Quantinuum over time, with the timing largely dependent on market valuations and the goal of maximizing long-term shareowner value.

What is the impact (if any) of the recent U.S. regional banking turmoil on Honeywell? Is the company seeing any headwinds among customers or suppliers?

We have not seen any material direct impact at this time from the banking crisis. However, we continue to monitor our smaller suppliers carefully, particularly the tier 3 and tier 4 suppliers in our Aerospace business, as this is where we believe any impact would be most acute.

In HBT, we see the higher interest rate environment, not the banking turmoil, as more of a demand headwind and obstacle to projects on the margin. However, it is important to remember that our HBT portfolio serves a diverse end-market set. In fact, U.S. commercial new builds represents well under 10% of total HBT sales.

Our balance sheet is strong, and we do not see the banking crisis materially impacting our ability to operate. Just last week, we raised another $3 billion to give us more flexibility for capital deployment and provide an additional safety measure against volatility in the debt market.

About Honeywell

Honeywell (www.honeywell.com) delivers industry specific solutions that include aerospace products and services; control technologies for buildings and industry; and performance materials globally. Our technologies help everything from aircraft, buildings, manufacturing plants, supply chains, and workers become more connected to make our world smarter, safer, and more sustainable. For more news and information on Honeywell, please visit www.honeywell.com/newsroom.

Honeywell uses our Investor Relations website, www.honeywell.com/investor, as a means of disclosing information which may be of interest or material to our investors and for complying with disclosure obligations under Regulation FD. Accordingly, investors should monitor our Investor Relations website, in addition to following our press releases, SEC filings, public conference calls, webcasts, and social media.

Forward Looking Statements

We describe many of the trends and other factors that drive our business and future results in this publication. Such dicussions contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). Forward-looking statements are those that address activities, events, or developments that management intends, expects, projects, believes, or anticipates will or may occur in the future. They are based on management’s assumptions and assessments in light of past experience and trends, current economic and industry conditions, expected future developments, and other relevant factors. They are not guarantees of future performance, and actual results, developments, and business decisions may differ significantly from those envisaged by our forward-looking statements. We do not undertake to update or revise any of our forward-looking statements, except as required by applicable securities law. Our forward-looking statements are also subject to a number of material risks and uncertainties that can affect our performance in both the near- and long-term. In addition, no assurances can be given that any plan, initiative, projection, goal, commitment, expectation, or prospect set forth in this presentation can or will be achieved. These forward-looking statements should be considered in light of the information included in this publication, our Form 10-K, and other filings with the Securities and Exchange Commission. Any forward-looking plans described herein are not final and may be modified or abandoned at any time.

Non-GAAP Measures

This publication contains financial measures presented on a non-GAAP basis. Refer to the Appendix of our 2023 Investor Day Presentation for reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures. Honeywell’s non-GAAP financial measures used in this publication are as follows:

- Segment profit, on an overall Honeywell basis, a measure by which we assess operating performance, which we define as operating income adjusted for certain items. A quantitative reconciliation of segment profit, on an overall Honeywell basis, to operating income has not been provided for forward-looking measures of segment profit and segment margin included herewithin. Management cannot reliably predict or estimate, without unreasonable effort, the impact and timing on future operating results arising from items excluded from segment profit. The information that is unavailable to provide a quantitative reconciliation could have a significant impact on our reported financial results. To the extent quantitative information becomes available without unreasonable effort in the future, and closer to the period to which the forward-looking measures pertain, a reconciliation of segment profit to operating income will be included within future filings.

- Organic sales growth, which we define as net sales growth less the impacts from foreign currency translation, and acquisitions and divestitures for the first 12 months following transaction date. A quantitative reconciliation of reported sales percent change to organic sales percent change has not been provided for forward-looking measures of organic sales percent change because management cannot reliably predict or estimate, without unreasonable effort, the fluctuations in global currency markets that impact foreign currency translation, nor is it reasonable for management to predict the timing, occurrence and impact of acquisition and divestiture transactions, all of which could significantly impact our reported sales percent change.

- Free cash flow, which we define as cash provided by operating activities less cash expenditures for property, plant and equipment; and free cash flow margin, which we define as free cash flow divided by net sales. We believe that free cash flow and free cash flow margin are non-GAAP metrics that are useful to investors and management as a measure of cash generated by operations that will be used to repay scheduled debt maturities and can be used to invest in future growth through new business development activities or acquisitions, pay dividends, repurchase stock, or repay debt obligations prior to their maturities. These metrics can also be used to evaluate our ability to generate cash flow from operations and the impact that this cash flow has on our liquidity.

1Gross margin excludes company-funded R&D, in line with the reporting change made in 1Q23

2Refer to the Appendix of our 2023 Investor Day Presentation for reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures

3Methodology for identifying ESG-oriented revenue is available at investor.honeywell.com (see ESG/ESG Information/Identification of ESG-Oriented Offerings)